Glopts provides clients with two multi-account management systems:MAM and MultiTerminal.

Convenient for traders to trade for their own multiple clients at the same time

MultiTerminal Advantages:

1. Manage more than 100 accounts

2. Start in one step

3. Investor's detailed report

4. Absolute safety

5. Easy to control

Application conditions:There is no threshold to apply, just click the download window below, one-click installation, you can use it.

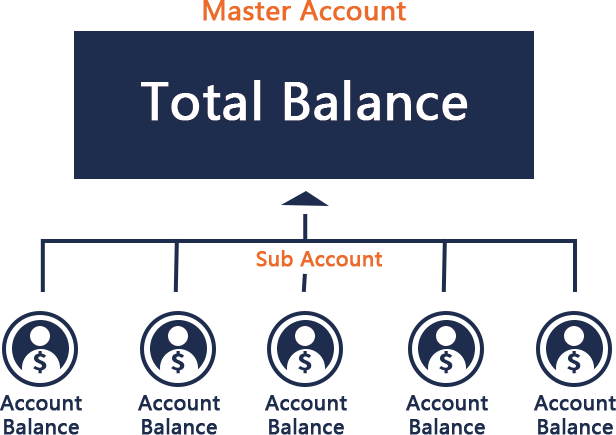

MAM Advantages:

1. Multiple trading accounts can be added at the same time

2. A variety of trading lot distribution models are available

3. Excellent execution ability, immediately allocate orders to sub-accounts

4. All orders are executed at the same time and the same price

5. Powerful order management function

6. Support intelligent trading

7. Advanced back-end multi-account management

Application conditions:The application needs to reach the deposit threshold, please contact Customer Service for more details.